Content

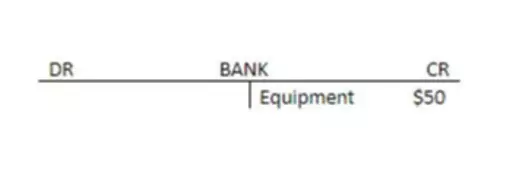

Contains a robust amount of natural Vitamin A. Recommended only in shorter periods of time for whole-body purification support process support, drainage support, kidney support, and liver support. Jenny Jacks is a high-end clothing store that sells men’s and women’s clothing, shoes, jewelry, and accessories. Because the store’s items are so expensive, it allows customers to make purchases using credit. When an item is sold on credit, the accounting manager enters the amount of the item into the books as an account receivable. Peace is a business consultant with many years of practice in the agricultural and real estate industry.

- Our consultants understand the importance of your relationships and will work seamlessly alongside your team.

- The average receivables turnover is simply the average accounts receivable balance divided by net credit sales; the formula below is simply a more concise way of writing the formula.

- It is very important for companies that heavily rely on their receivables when it comes to their cash flows.

- The average collection period could imply that the company isn’t as efficient as it should be when it comes to collecting accounts receivable.

- The downside is that, all too often, the same students who need financial aid the most struggle to complete the FAFSA and navigate administrative hurdles such as income verification.

- Congress could choose to cap the federal share at 100 percent or allow it to go above 100 percent in order to assist states that have community college tuition rates above the national average .

However, the figure could also indicate that the corporation offers more flexible payment arrangements for outstanding invoices. On the other hand, companies with declining sales may see an increase in their ACP, if the period of time being analyzed is too short, as the lower recent sales vs. the larger receivables from past higher sales may distort the ratio. For this reason, it its advised that the ACP analysis is made annually, to avoid such distortions coming from unexpected changes in either sales, particular difficulties to collect certain payments or even due to seasonality. Bro Repairs is a small business that offers maintenance of air conditioning units to commercial establishments, offices and households. They usually give their commercial clients at least 15 days of credit and these sales constitute at least 60% of their annual $2,340,000 in revenues. At the beginning of this year, Bro Repairs accounts receivables were $124,300 and by the end of the year the receivables were $121,213.

You must cCreate an account to continue watching

It is slightly high when you consider that most companies try to collect payments within 30 days. This company would be best served by taking on more short-term projects in order to decrease their average collection period. However, if the company knows a large account receivable is about to be paid, this might be reasonable. The company needs to adjust its credit policies to lower the collection period down to a week and be able to meet its short-term obligations. This necessitates an examination of your company’s credit policy and the implementation of corrective steps, such as tightening credit requirements or making credit conditions more obvious to your clients. For one thing, the ratio must be evaluated in comparison to being significant. Is the company’s capacity to collect receivables rising or deteriorating in comparison to previous years?

When a plan fails the ADP/ACP test, correction is made by either refunding amounts to the HCEs or providing additional company contributions to NHCEs or some combination of the two. As long as the correction is made on a timely basis, there are no penalties.

Can’t change the ACP

By automating them with HighRadius Autonomous Receivables, businesses can significantly improve their order to cash cycle. Average collection period also known as ‘ratio of days to sales outstanding’ is the average number of average collection period days the company takes to collect its payment after it makes a credit sale. The financial ratio gives an indication of the firm’s liquidity by providing an average number of days required to convert receivables into cash.

- Very few plans offer it, but for those that do, any such after-tax contributions must be added to the company match when performing the ACP test.

- The company can decide on the means to collect the balance amount by knowing their ACP.

- Customers’ cash flows may be impacted by general economic conditions, prompting them to postpone payments to their suppliers.

- If they have lax collection procedures and policies in place, then income would drop, causing financial harm.

By defining the federal match rate as a function of state wealth through a simple formula, Congress would increase the incentive for lower-resourced states to participate. An example of this formula using states’ child poverty rates is provided below. For the company, its average collection period figure can mean a few things. It may mean that the company isn’t as efficient as it needs to be when staying on top of collecting accounts receivable. However, the figure can also represent that the company offers more flexible payment terms when it comes to outstanding payments. A good average collection period ratio will depend on the industry and the company’s credit policies. This figure tells the accounting manager that Jenny Jacks customers are paying every 36.5 days.